It is crucial, when planning for the care of special needs children that a parent talk with a good estate planning attorney. Giving a special needs child an inheritance will very likely diminish or eliminate benefits (including means-tested government benefits) that a special needs child is receiving. A better way to benefit a special needs child upon death is to create a "Third-Party" special needs trust. We at Hughes Estate Group, Attorneys, would be glad to answer any questions you may have regarding special needs trusts. Give us a call at 801.364.5600.

There are good sources (in addition to estate planning attorneys) that discuss special needs trusts. A recent article found in the July/August 2009 issue of Probate & Property by Sebastian V. Grassi Jr., titled "Estate Planning for a Family with a Special Needs Child" touches on Special Needs Trusts. Mr. Grassi says, "The principal purpose of a third-party created and funded SNT is to provide an inheritance for the special needs child without risking the loss of important means-tested government benefits such as SSI, Medicaid, and so on." (p. 17)

Another resource is the book titled, Special Needs Trust Administrative Manual, a Guide For Trustees, found online. While this guide is sometimes focused on Massachussets law, the guide nevertheless gives you not only an idea of what special needs trustees are required to do, but how a special needs trust works.

Here at Hughes Estate Group we subscribe to the "Special Needs Trust Handbook," published by Aspen Publishers which is updated on a regular basis, keeping our Firm up-to-date on Special Needs issues. It is expensive but is a resource for the person wishing to be really up to speed in the Special Needs arena.

In addition, the Nolo Press book titled "Special Needs Trusts" by Stephen Elias is a good book for laymen to get an overview of Special Needs Trusts in preparation to talking with a good attorney. We would highly discourage using the boilerplate forms in the book. The forms do not cover a wide variety of critical tax and legal issues involved in establishing and administering special needs trusts and may cause critical harm to your special needs beneficiary. Other than the forms, the book is a good introduction to Special Needs Trusts.

In addition, the following websites are helpful.

Social Security Trust Spotlight

Special Needs Trust for Austism

The Center for Special Needs Trust Administration, Inc.

Thursday, September 3, 2009

Thursday, August 6, 2009

Get a Living Will

The Obamas have living wills and you should, too. You should also have powers of attorney as well. If you are in Utah and need help with these documents, contact us.

The Obamas have living wills and you should, too. You should also have powers of attorney as well. If you are in Utah and need help with these documents, contact us.H/T Death and Taxes blog.

Labels: Doc Prep

Estate Planning

Wednesday, August 5, 2009

Tuesday, August 4, 2009

The C.L.A.S.S. Act (Community Living Assistance Services and Support. To transform the way people pay for long-term care. Participants would receive daily benefits. They could use this money for home care adult day programs, or assisted living or nursing homes.

The C.L.A.S.S. Act (Community Living Assistance Services and Support. To transform the way people pay for long-term care. Participants would receive daily benefits. They could use this money for home care adult day programs, or assisted living or nursing homes.It creates a national insurance trust that people can voluntarily participate in. It's a publicly sponsored insurance plan. You have to pay premiums that will be average around $65 a month for five years before you can draw benefits. It will be self-funding.

While Medicaid already pays for some of the same services, you have to be really sick and really poor to qualify. The plan allows you to have no more than $2,000 in assets plus your house, which they will put a lien on when you die for reimbursement of your care. This plan has been proposed as a way of easing the burdens of middle class families.

The bill was introduced this summer by Senators Edward Kennedy and Tom Harkin and Representatives John Dingell and Frank Pallone.

In the Press Release on the bill they said that there are currently 10 million Americans in need of long-term care services. It quotes Sen. Kennedy, "Too many Americans are perfectly capable of living a life in the community, but are denied the supports they need. They languish in needless circumstances with no choice about how or where to obtain these services.Too often, they have to give up the American Dream – the dignity of a job, a home, and a family – so they can qualify for Medicaid, the only program that will support them. The bill we propose is a long overdue effort to offer greater dignity, greater hope, and greater opportunity. It makes a simple pact with all Americans – ‘If you work hard and contribute, society will take care of you when you fall on hard times.’”

Labels: Doc Prep

Medicaid and Government Benefits

Monday, August 3, 2009

Mysterious Syncronicity and the Popularity of Obituaries

The Flourishing Life of the Obit Desk

By Andrew Alexander

Sunday, August 2, 2009

"Did you catch the news about the golfer who died of a stroke? How about the librarian who checked out? Or the math teacher whose number was up?

They've heard them all on newspaper obituary desks."

So starts a Washington Post Post Mortem article today about the paper's obituary column. Mr. Alexander goes on to tell us that the obituary departments were at one time a starting point for novice reporters or the department to which they were sent when their careers foundered.

But today, obituaries are gaining increased audience and revenues. In the past six month's the Post's Obituary Web site have had almost three times as many pages as their popular "subsection" in the Metro section.

And while reporters once viewed the obit desk as the worst assignment, some now see working there as one of the best.

Always something interesting at the Post Mortem. Today's obituaries include the Boston DJ George Taylor Morris who started the urban legend about a mysterious synchronicity between Pink Floyd's "Dark Side of the Moon" and the movie classic "The Wizard of Oz." If you start them out at the same time "the lunatic is on the grass" line comes just when the Scarecrow begins dance near a green lawn. The line "got to keep the loonies on the path" comes just as Dorothy and the Scarecrow start down the Yellow Brick Road.

Always something interesting at the Post Mortem. Today's obituaries include the Boston DJ George Taylor Morris who started the urban legend about a mysterious synchronicity between Pink Floyd's "Dark Side of the Moon" and the movie classic "The Wizard of Oz." If you start them out at the same time "the lunatic is on the grass" line comes just when the Scarecrow begins dance near a green lawn. The line "got to keep the loonies on the path" comes just as Dorothy and the Scarecrow start down the Yellow Brick Road.They've been cued up for you at the RollingStone if you want to have a look.

Labels: Doc Prep

Obituaries

Thursday, July 30, 2009

Hint, Hint

The Three-Day Weekend Experiment

By Freakonomics

For the past year, all government employees in Utah have had a four-day workweek. The results of the trial run are in, and they look good: the state says it saved $1.8 million in electrical bills, eliminating 6,000 metric tons of carbon dioxide, while 82 percent of workers say they like the new scheme.

One minor downside of the new schedule from an estate planning perspective is that working with any government entity in transferring assets into duly executed trusts or other estate planning documents excludes Fridays. But asset transfer work usually can be done through the mail and does not require personal visits to government buildings.

By Freakonomics

For the past year, all government employees in Utah have had a four-day workweek. The results of the trial run are in, and they look good: the state says it saved $1.8 million in electrical bills, eliminating 6,000 metric tons of carbon dioxide, while 82 percent of workers say they like the new scheme.

One minor downside of the new schedule from an estate planning perspective is that working with any government entity in transferring assets into duly executed trusts or other estate planning documents excludes Fridays. But asset transfer work usually can be done through the mail and does not require personal visits to government buildings.

And since we're on the subject of Michael Jackson . . .

Some site called Contactmusic.com is reporting that Jackson's father has confirmed that Michael was the biological father of Omer Bhatti, the boy that's been rumoured to be his fourth child. Joe Jackson noted the striking similarities saying "Yes I knew he had another son, yes I did. He looks like a Jackson, he acts like a Jackson, he can dance like a Jackson. This boy is a fantastic dancer as a matter of fact. I don't know (if he will be the future of the Jacksons). I can't say that yet until I see it happen."

Some site called Contactmusic.com is reporting that Jackson's father has confirmed that Michael was the biological father of Omer Bhatti, the boy that's been rumoured to be his fourth child. Joe Jackson noted the striking similarities saying "Yes I knew he had another son, yes I did. He looks like a Jackson, he acts like a Jackson, he can dance like a Jackson. This boy is a fantastic dancer as a matter of fact. I don't know (if he will be the future of the Jacksons). I can't say that yet until I see it happen." Uh oh.

Labels: Doc Prep

Celebrity

The dead just keep on getting richer

Speaking of Michael's estate, it's growing. Billboard is reporting that the 2008 "King of Pop" is still No.1 in Germany, Austria, Switzerland, Italy and Holland. It's the set's Fourth week on top of the European top 100 albums chart. He still has three titles on the pan-European list - "The Collection" and the"the Essential" are at #s 2 and 3. "The Essential" is a favorite in the UK and Ireland with sales for a fourth week on top.

Speaking of Michael's estate, it's growing. Billboard is reporting that the 2008 "King of Pop" is still No.1 in Germany, Austria, Switzerland, Italy and Holland. It's the set's Fourth week on top of the European top 100 albums chart. He still has three titles on the pan-European list - "The Collection" and the"the Essential" are at #s 2 and 3. "The Essential" is a favorite in the UK and Ireland with sales for a fourth week on top.

Labels: Doc Prep

Estate Administration

In Estate Planning, Surprise is Unwelcome.

A trustee is a trusted fiduciary who holds the utmost responsibility and duty in caring for another's assets. It's not just a duty of care and loyalty, not just the morals of the marketplace, and not just honesty alone, but the "punctilio of an honor the most sensitive." This statement from Judge Cardozo is the repeated classic statement for describing the fiduciary duties required of all trustees. An article in the Utah Bar Associations Bar Journal by Scott M. McCullough and David W. Macbeth, two Utah attorneys, describes the difficulty of choosing the right trustee.

A trustee is a trusted fiduciary who holds the utmost responsibility and duty in caring for another's assets. It's not just a duty of care and loyalty, not just the morals of the marketplace, and not just honesty alone, but the "punctilio of an honor the most sensitive." This statement from Judge Cardozo is the repeated classic statement for describing the fiduciary duties required of all trustees. An article in the Utah Bar Associations Bar Journal by Scott M. McCullough and David W. Macbeth, two Utah attorneys, describes the difficulty of choosing the right trustee.They state the case for and against a family member. In many estates a family member is a good choice. For others, a family member is not a good choice, because of the complexity of the financial affairs and family dynamics. The case against a family trustee might be a lack of expertise or experience, finances, time restraints, lack of supervision. Also there can be a lot stress and pressure on that family trustee from other family members.

In the Huffington Post, Jordan M. Atin addresses explains the trustee selection in the Michael Jackson case. Jackson was very specific in appointing his attorney John Branca and music executive John McClain to be the trustees of his estate.

Some of the reasons are obvious. Jackson's estate includes very complicated tax issues, valuations, and royalties and music related properties that require a great deal of expertise to handle. And perhaps Michael felt that the administration of his estate would be a burden to his family.

Michael's mother is obviously disappointed in his decision, but the author says it's probably not about the money. Sometimes family members simply want their place in the life of their loved one "properly recognized."

The worst thing you want to do is suprise your survivors. Surprise and disappointment can lead to suspicion and litigation.

Labels: Doc Prep

Estate Planning

Caring for our Elders

What if your parent gets sick or falls and has to have emergency care? Then you learn that her insurance falls short when the hospital calls you for payment? Are you responsible for your parent's health care when they can't afford it on their own? These are the questions posed by Katherin C. Pearson, Professor of Law at Penn State Dickson School of Law in this article "Finances, Families and "Filial" Laws: The Real World as Classroom.

What if your parent gets sick or falls and has to have emergency care? Then you learn that her insurance falls short when the hospital calls you for payment? Are you responsible for your parent's health care when they can't afford it on their own? These are the questions posed by Katherin C. Pearson, Professor of Law at Penn State Dickson School of Law in this article "Finances, Families and "Filial" Laws: The Real World as Classroom.These filial responsibility laws are on the books in thirty states, including Utah.

Utah Code 17-14-2. Order in which relatives are liable.

Children shall first be called upon to support their parents, if they are of sufficient ability; if there are none of sufficient ability, the parents of such poor person shall be next called upon; if there are neither parents nor children, the brothers and sisters shall next be called upon; and if there are neither brothers nor sisters, the grandchildren of such poor person shall next be called upon, and then the grandparents.

Utah law requires children to be called on for support if they are of "sufficient ability." It also calls upon the grandparent to step up for the adult child. There is no case law in Utah that I could find.

According Professor Pearson, many states repealed or stopped enforcing filial law when Medicare and Medicaid were created in 1965. But long-term care is expensive and people are living longer. Should we have filial support laws to encourage families to take care of one another as a way to help strapped public plans?

Less than a third of older Americans are able to pay for two or three years of nursing home care. Medicaid is the federal-state health care program and the major funder of long-term care. When seniors exhaust limited Medicare benefits, those without long-term care insurance have to pay for their own care. If they spend their assets down again they can re-qualify for Medicaid.

Federal and state law allows Medicaid to seek reimbursement from recipients’ estates though most Medicaid recipients have no estate when they die. Many middle-income seniors transfer ownership of assets to their children to become Medicaid eligible which makes Medicare and “inheritance protection plan.” Medicaid has always excluded children’s assets in considering their parent’s eligibility. Enforcement of filial responsibility law would make much of the estate planning irrelevant. Nation Center for Policy Analysis

Another problem is putting adult children a precarious position while they are raising their own children and facing their own retirement. In an article in the AARP Bulletin today, Beth Baker quotes Bruce Vladek’s “Unloving Care-The Nursing Home Tragedy, “The drafters of Medicaid specifically sought to insulate middle-aged children from the prospect of financial catastrophe engendered by the need to institutionalize aged parents. … Middle-aged children are not forced to exhaust all their own resources in order to provide nursing home care for their parents, but they are forced to witness the destruction of their inheritances, for which their parents may have scrimped for a lifetime.”

Another problem is putting adult children a precarious position while they are raising their own children and facing their own retirement. In an article in the AARP Bulletin today, Beth Baker quotes Bruce Vladek’s “Unloving Care-The Nursing Home Tragedy, “The drafters of Medicaid specifically sought to insulate middle-aged children from the prospect of financial catastrophe engendered by the need to institutionalize aged parents. … Middle-aged children are not forced to exhaust all their own resources in order to provide nursing home care for their parents, but they are forced to witness the destruction of their inheritances, for which their parents may have scrimped for a lifetime.”The article tells the story of Elnora Thomas of Tampa, Fla., who in 2007, received a letter in the mail. Her mother's nursing home was suing her for $50,000 in unpaid bills. She had no money so they were going to put a lien on ther house.

The nursing home went after her and her sister after their stepfather refused to cooperate in the Medicaid application process. Fortunately, nonprofit legal services of Philadelphia appealed the case until Medicaid came through.

The nursing home went after her and her sister after their stepfather refused to cooperate in the Medicaid application process. Fortunately, nonprofit legal services of Philadelphia appealed the case until Medicaid came through.The PA Elder, Estate & Fiduciary Law Blog describes recent action where the law is bing used in Pennsylvania. A story in the Philadelpha Enquirer reported on a 50-year-old man who was struggling to pay his mortgage and college costs for his daughter. He was sued by a nursing home for an $8,000 bill. Another story from Pennsylvania was reported by ABC News of a 39-year-old Pennsylvania woman who was sued for more than $300,000 in unpaid for her parents care. She and her husband are both already working two jobs. She says they just don't have it.

Many children do contribute much to their parents care. AARP estimates that there are 34 million family caregivers who provide the equivalent of $375 billion in care and 54% of those have sacrificed financially.

Labels: Doc Prep

Elder Law

Wednesday, July 29, 2009

The Girl with the Valuable Laptop

After the 60-cigarette a day, 50-year-old Swedish author died n 2004 of a heart attack, his works became international best sellers, selling more than 12 million copies. Stieg Larrson's best seller "The Girl with the Dragon Tattoo" has a plot that centers on computer hacking and a neo-punk heroine called Lisbeth Salander. The other's are "The Girl Who Played with Fire" and "The Girl Who Kicked the Hornet's Nest." The three titles comprise what is known as the "Millennium Series." Big name Hollywood types are vying to act and produce a film based on the works - George Clooney, Johnny Depp, and Quentin Tarantino and Martin Scorsese.

After the 60-cigarette a day, 50-year-old Swedish author died n 2004 of a heart attack, his works became international best sellers, selling more than 12 million copies. Stieg Larrson's best seller "The Girl with the Dragon Tattoo" has a plot that centers on computer hacking and a neo-punk heroine called Lisbeth Salander. The other's are "The Girl Who Played with Fire" and "The Girl Who Kicked the Hornet's Nest." The three titles comprise what is known as the "Millennium Series." Big name Hollywood types are vying to act and produce a film based on the works - George Clooney, Johnny Depp, and Quentin Tarantino and Martin Scorsese.The big problem, however, is that Larsson's estate in in dispute. The author died suddenly and without a will so the estate goes to his immediate family by law. His immediate relatives were a father and brother, from whom he was reportedly estranged.

It's complicated by his 30-year common law wife, Eva Gabrielsson. She has made a bid for the estate based on their long-term relationship. She also supported through all of the lean years and helped him in his research for the books.

She is trying to get the literary rights, but the family says no deal. The case has caused quite a stir in Sweden and many have called for a change in the law that would recognize common-law spouses in cases like this. "Support Eva" protests have erupted online from all parts of the world.

Ms Gabrielsson, has a big bargaining chip. She has this laptop that has a 200-page draft manuscript of a fourth novel. It is property now worth millions. There are rumors that it might contain plots for another six books.

More at the Guardian.

Labels: Doc Prep

Inheritance Disputes

Here's a heads up!

Cremation Solutions sells urns" that look like the person whose ashes they hold.

"Now we can create a custom urn in the image of your loved one or favorite Celebrity."

via boing boing via Cynical-C

Labels: Doc Prep

Celebrity,

Funerals,

Just for Fun

Tuesday, July 28, 2009

Dig Utah!

Rock art from Range Creek from the Utah history site.

Rock art from Range Creek from the Utah history site.Utah's Range Creek, one of the most pristine examples of Fremont Indian culture, is the subject of a PBS show in which archaeologists armed with pricey technology parachute into a site for 72 hours.

"I've been in archaeology for 30 years and have never seen anything like it," said Eric Deetz of the site in central Utah, occupied by the Fremont 1,000 years ago and left virtually undisturbed until 2001, when it was purchased by a nonprofit Trust for Public Land. The site is now owned by the state, according to this Salt Lake Tribune article.

Archaeologists are excited because the sites are neither looted nor disturbed.

Labels: Doc Prep

Art-Books-Movies,

Utah

After 36 Years, 100 Greek Relatives No Longer Prevail

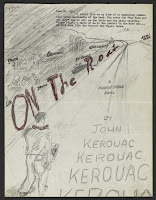

A Florida judge ruled today that a will disposing of Jack Kerouac's estate is a fake. Kerouac, the Beat Generation author, left his estimated $20 million estate to his mother Gabrielle in a valid and accepted will. Gabrielle in turn allegedly signed a will, leaving Kerouac's estate and royalties to Kerouac's divorced wife Stella Sampas Kerouac, who was a devoted caretaker of Gabrielle. Gabrielle then died in 1973. For 21 years, Kerouac's estate and royalties were controlled by Stella Sampas Kerouac's family.

A Florida judge ruled today that a will disposing of Jack Kerouac's estate is a fake. Kerouac, the Beat Generation author, left his estimated $20 million estate to his mother Gabrielle in a valid and accepted will. Gabrielle in turn allegedly signed a will, leaving Kerouac's estate and royalties to Kerouac's divorced wife Stella Sampas Kerouac, who was a devoted caretaker of Gabrielle. Gabrielle then died in 1973. For 21 years, Kerouac's estate and royalties were controlled by Stella Sampas Kerouac's family.In 1994, Jan Kerouac, the author's daughter by another marriage, saw a copy of her grandmother Gabrielle's will and brought a suit contesting the validity of Gabrielle's will. During the process of the litigation, in 1996, Jan died and the suit was taken up by a nephew, Paul Blake.

The court ruled that Gabrielle was too sick before her death and could not have signed the will. Handwriting experts also determined Gabrielle's signature was fake.

The AP reports that shortly before his death from alcoholism at age 47, Jack Kerouac wrote his nephew Paul a letter, expressing his desire to leave all of his work and belongings behind to his mother, "and not to leave a dingblasted (two expletives) thing to my wife's one hundred Greek relatives," he wrote. Unfortunately, it seems the Greek relatives prevailed, until now.

Commentary by Hughes Estate Group. The entire problem here revolves around Jack's and Gabrielle's estate planning. First, if Jack did not ever want his estate going to his prior wife Stella, there are numerous things he could have done to prevent that and provide for his mother at the same time. Jack just didn't think clearly here.

Second, Gabrielle obviously did not do proper planning before she died. If she wanted to leave everything to Stella, she could have done so. If not, she could have done so. She apparently did not do anything, allowing her daughter-in-law Stell to prepare and sign a forged will.

Third, Jack's daughter Jan should have been all over this situation back in 1973, when her grandmother Gabrielle died. Why did she wait for 21 years until 1994 to bring a lawsuit? Hmmmm, there is more to this story than is reported. But, nevertheless, the problem ultimately rests with Jack and Gabrielle and their shortsightedness.

I (Craig Hughes) never cease to be amazed at the frequency in which many wealthy people turn off their minds when it comes to adequate estate planning. I can understand folks with modest estates not getting around to planning, but the frequency of stories in which the wealthy disengage their minds in regard to estate planning is interesting.

Labels: Doc Prep

Caregivers,

Estate Fraud,

Inheritance Disputes,

Wills

He Wasn't What She Thought He Was.

Gabrielle Mee, who died last year, left her multi-million dollar estate to the Legionaires of Christ which is located in Orange, Connecticut. She had given the Order a good deal of money before she died as well. She was a devout woman who took Holy Communion every day of her life since the age of 12. She lived at the order's center for consecrated women in Greenville, R.I. for at least a decade.

Gabrielle Mee, who died last year, left her multi-million dollar estate to the Legionaires of Christ which is located in Orange, Connecticut. She had given the Order a good deal of money before she died as well. She was a devout woman who took Holy Communion every day of her life since the age of 12. She lived at the order's center for consecrated women in Greenville, R.I. for at least a decade.The family is challenging the will based on a sex scandal involving the order's founder, the Rev. Marcial Maciel Degollado. He was accused of molesting more than a dozen young boys, fathering an illegitimate child, and misappropriate funds.

In May 2006, Pope Benedict XVI disciplined Degollado, inviting him to "a reserved life of prayer and penitence"; no explanation was given to the public or to the Legionaries of Christ. Degollado died in 2008 at age 87.

Family members say they believe that if Mee knew of the sex scandal and Vatican investigation, she would not have made the order her beneficiary.

The court has given the family until their October court date to gather evidence, subpoena records, and depose witnesses.

Big H/T to Patrick Madrid

Labels: Doc Prep

Celebrity,

Inheritance Disputes,

Wills

Monday, July 27, 2009

Ruling from the Grave

Farrah Fawcett has reportedly left her $6 million dollar estate to her son Redmond who is currently in prison for drug possession. Two trustees were named to make sure the money helps him stay sober instead of as a means to "destroy himself," according to this Fox News report.

Farrah Fawcett has reportedly left her $6 million dollar estate to her son Redmond who is currently in prison for drug possession. Two trustees were named to make sure the money helps him stay sober instead of as a means to "destroy himself," according to this Fox News report.

Labels: Doc Prep

Trusts

It's Not Going Anywhere. At Least For Now.

The de Young Museum's collection of Papua New Guinea tribal art, which has been the subject of a lengthy inheritance dispute, is not going anywhere. San Francisco judge A. James Robertson II upheld a temporary order preventing the collection from being seized or sold to pay for part of the $30 million debt John Friede owes his brothers in the matter of the settlement of their mother's estate.

The de Young Museum's collection of Papua New Guinea tribal art, which has been the subject of a lengthy inheritance dispute, is not going anywhere. San Francisco judge A. James Robertson II upheld a temporary order preventing the collection from being seized or sold to pay for part of the $30 million debt John Friede owes his brothers in the matter of the settlement of their mother's estate.We've followed the story here, here, and here,

The mother of the Friede brothers was Evelyn A.J. Hall, sister of publishing tycoon Walter Annenberg.

Read more at sfgate.com.

Labels: Doc Prep

Inheritance Disputes

Estate Auction of Betty James a.k.a. the Slinky Lady

Saturday the central Pennsylvania estate of the matriarch of the toy company was up for auction. It included some unusual versions of that "fun and wonderful toy."

Saturday the central Pennsylvania estate of the matriarch of the toy company was up for auction. It included some unusual versions of that "fun and wonderful toy." Betty James died in November at age 90. She co-founded James Industries Inc. in Chester County in 1945 with her husband, who invented the springy Slinky.

Her interesting NY Times Obituary is here. You can take a virtual tour of the estate at roaninc.com

Labels: Doc Prep

Estate Sales

Wednesday, July 22, 2009

Powers of Attorney

A recent NY Daily News article explains why it's so important to have a power of attorney. No one ever expects to become incapacitated, but it happens all the time. You should choose someone you know and trust who will be able to step in and take care of your affairs if you are unable to.

New York has passed new laws that change the rules about powers of attorney. Among the new rules: if you choose to give someone the right to make money transfers of more then $500, you will have to sign a separate statement witnessed by two people authorizing the person to make such transfers.

The new law will also allow you to appoint someone to monitor the actions of the person you name as your agen in a power of attorney, providing more checks and balances.

The new law covers new agreements; existing power of attorney statements remain in effect.

The New York law provides people with more protection, but at a cost. If you choose to use a lawyer, what may have cost you $200 before could cost $500 or more.

While many people find power of attorney forms at a stationery store or online, most lawyers consider that a bad move.

“You may not be protecting yourself as adequately as you should be,” The Daily News quotes Long Island Attorney Jennifer Cona said. “This is one of the most important documents you’ll ever sign. Don’t take it lightly.”

We at Hughes Estate Group would add that every term and concept found in the new New York law designed to protect consumers is already incorporated into our comprehehsive, 40-plus page financial power of attorney.

Read the article here

New York has passed new laws that change the rules about powers of attorney. Among the new rules: if you choose to give someone the right to make money transfers of more then $500, you will have to sign a separate statement witnessed by two people authorizing the person to make such transfers.

The new law will also allow you to appoint someone to monitor the actions of the person you name as your agen in a power of attorney, providing more checks and balances.

The new law covers new agreements; existing power of attorney statements remain in effect.

The New York law provides people with more protection, but at a cost. If you choose to use a lawyer, what may have cost you $200 before could cost $500 or more.

While many people find power of attorney forms at a stationery store or online, most lawyers consider that a bad move.

“You may not be protecting yourself as adequately as you should be,” The Daily News quotes Long Island Attorney Jennifer Cona said. “This is one of the most important documents you’ll ever sign. Don’t take it lightly.”

We at Hughes Estate Group would add that every term and concept found in the new New York law designed to protect consumers is already incorporated into our comprehehsive, 40-plus page financial power of attorney.

Read the article here

Labels: Doc Prep

Powers of Attorney

Tuesday, July 21, 2009

The Perfect Estate Planner

Jeane Dixon's estate is up for sale, including her crystal balls. The auction estimate for each crystal ball is $1,000 to $10,000.

Jeane Dixon's estate is up for sale, including her crystal balls. The auction estimate for each crystal ball is $1,000 to $10,000. Jeane Dixon (1918-1997) was one of the most well known astrologers and psychics of the 20th century. She had a syndicated astrology column and a best-selling biography. Dixon was an astrological adviser to several celebrities; most famously Nancy and Ronald Reagan. Among her many predictions, including annual New Year predictions, Jeane Dixon is best known for what some believe was her prediction of John F. Kennedy’s assassination in Parade magazine in 1956.

We think a crystal ball would be the perfect estate planning tool.

Labels: Doc Prep

Estate Planning,

Estate Sales

Monday, July 20, 2009

Pre-nup Contested on Claim Spouse is Rich

As reported by tmz, George Lazenby, who once played James Bond in 1969, is challenging his prenuptial agreement on grounds that his estranged wife and Baltimore native Pamela Shriver has a much bigger house and is so rich it makes him feel bad, and that his kids don't take him seriously. Pamela Shriver is a former tennis professional with 22 Grand Slam doubles titles and a 1988 Olympic gold medal. Lazenby is asking a judge to void the prenup and award him $16,133 in monthly support.

As reported by tmz, George Lazenby, who once played James Bond in 1969, is challenging his prenuptial agreement on grounds that his estranged wife and Baltimore native Pamela Shriver has a much bigger house and is so rich it makes him feel bad, and that his kids don't take him seriously. Pamela Shriver is a former tennis professional with 22 Grand Slam doubles titles and a 1988 Olympic gold medal. Lazenby is asking a judge to void the prenup and award him $16,133 in monthly support.He says his wife is "30 times a millionaire" and he has only a million. Boo hoo. Is Lazenby essentially asking the court to void a prenup because it hurts his pride that his wife is so much richer than he? Not a very convincing argument. We say that if the pre-nup is valid, it's too late to change his mind now.

In Utah, courts do in fact honor pre-nuptial agreements, but only if they meet strict criteria. Pre-nuptial agreements are clearly the type of document you want a competent attorney to draft. At Hughes Estate Group we draft pre-nup agreements. We recently had one of our agreements challenged and upheld in litigation. We can help you do these agreements right.

Labels: Doc Prep

Pre-nuptial agreements,

Wealth

Lost Inheritances

The Sacramento Bee reports that California's unclaimed property program is sitting on billions in forgotten money owed to thousands of businesses and individuals. It's from dozens of sources: overlooked bank accounts; stocks, bonds and dividends; uncashed paychecks; abandoned safe deposit boxes; misplaced insurance policies; utility bill refunds; or even that security deposit from your first college apartment.

In the last five fiscal years, California's unclaimed property office has returned $1.37 billion from more than 1.4 million accounts held by individuals and businesses, according to state controller's spokesman Jacob Roper.

How could so many lose track of so much?

"A lot of larger assets we're holding are inheritances that people don't know about," said Ruth Holton-Hodson, who oversees the state's unclaimed property program. "Older generations were very private about their incomes and often didn't share that with their children. They search our site and find, 'Oh, my goodness, Grandma had a bank account or Aunt Sally had 15 shares of GM.' "

In California you look at www.claimit.ca.gov or call 800-922-4647. In other states and Canada the National Association of Unclaimed Property Administrators has a site at missingmoney.com.

At Hughes Estate Group, we see unclaimed property issues as a sign of extraordinarily poor or nonexistent estate planning. Even for those with plans in place, the lesson here is simple: COMMUNICATE. You must communicate with your beneficiaries and fiduciaries where a complete list of all your assets and your will and trust can be found when you are gone.

In the last five fiscal years, California's unclaimed property office has returned $1.37 billion from more than 1.4 million accounts held by individuals and businesses, according to state controller's spokesman Jacob Roper.

How could so many lose track of so much?

"A lot of larger assets we're holding are inheritances that people don't know about," said Ruth Holton-Hodson, who oversees the state's unclaimed property program. "Older generations were very private about their incomes and often didn't share that with their children. They search our site and find, 'Oh, my goodness, Grandma had a bank account or Aunt Sally had 15 shares of GM.' "

In California you look at www.claimit.ca.gov or call 800-922-4647. In other states and Canada the National Association of Unclaimed Property Administrators has a site at missingmoney.com.

At Hughes Estate Group, we see unclaimed property issues as a sign of extraordinarily poor or nonexistent estate planning. Even for those with plans in place, the lesson here is simple: COMMUNICATE. You must communicate with your beneficiaries and fiduciaries where a complete list of all your assets and your will and trust can be found when you are gone.

Labels: Doc Prep

Communication,

Estate Planning,

Inheritance,

Probate,

Trusts,

Wealth,

Wills

Beat it, Just Beat it

According to legal documents filed by Katherine Jackson's attorneys, Michael Jackson's trust included a "no-contest clause." If a beneficiary attempts to challenge the terms of the trust terms in court, the challenger can be disinherited.

Apparently Katherine Jackson has not completely given up on administering Jackson's estate, so she is stepping lightly and asking the court to determine if an objection to the appointment of trust-stipulated trustees John McClain and John Branca would constitute a violation of the no-contest clause. A hearing is scheduled to take place Aug. 3.

In Utah, a no-contest clause is a sure sign of a boilerplate document. Here, no-contest clauses are simply unenforceable if probable cause exists for instituting a contest. (Utah Code sections 75-2-515, 75-3-905, and 75-7-112.) It is often quite easy for a beneficiary to establish some probable cause for contesting a will or trust. That is not to say that the contest will succeed; such contests in fact often fail. But it is difficult to disinherit a beneficiary for bringing the contest. If a person has a concern about preventing contests, we at Hughes Estate Group have foolproof measures to prevent such contests. Cheap "no-contest" clauses are not the solution.

Labels: Doc Prep

Inheritance Disputes,

No-contest clauses,

Probate,

Trusts

Financial Abuse by Caretakers

The New York Times reports that estate battles are breaking out all over, on estates large and small, and oh boy are they nasty.

One story tells of a 99 year-old man who married his caretaker. Even though she wasn't in his will, his 48-year-old wife is suing for her statutorily defined share of his estate. His sons say he suffered from severe dementia.

Another caretaker is being accused of tricking a woman she took care of for eight years. Three years after the woman was diagnosed with dementia the caretaker drained the bank accounts and transferred the home into her name.

A good probate and estate planning attorney can ensure these types of situations do not occur. The way to do so is with comprehensive powers of attorney, thorough caregiver agreements, very tight amendment and revocation procedures in documents, complete funding of trusts, and clear and appropriate communication with beneficiaries and fiduciaries while you are competent. For Utahns, contact Hughes Estate Group, Attorneys, (800-422-0627) if anything mentioned in this article strikes close to home.

One story tells of a 99 year-old man who married his caretaker. Even though she wasn't in his will, his 48-year-old wife is suing for her statutorily defined share of his estate. His sons say he suffered from severe dementia.

Another caretaker is being accused of tricking a woman she took care of for eight years. Three years after the woman was diagnosed with dementia the caretaker drained the bank accounts and transferred the home into her name.

A good probate and estate planning attorney can ensure these types of situations do not occur. The way to do so is with comprehensive powers of attorney, thorough caregiver agreements, very tight amendment and revocation procedures in documents, complete funding of trusts, and clear and appropriate communication with beneficiaries and fiduciaries while you are competent. For Utahns, contact Hughes Estate Group, Attorneys, (800-422-0627) if anything mentioned in this article strikes close to home.

Labels: Doc Prep

Communication,

Elder Abuse,

Estate Planning,

Inheritance Disputes,

Probate

The Connecticut state attorney general stepped into a probate proceeding to challenge the sales agreement stemming from 2005 that challenged the legitimacy of a sales agreement in which an elderly Greenwich woman agreed to sell her home to two men for less than half of what it was worth at the time.

Attorney General Richard Blumenthal intervened after Mona Lee Johnson, of Greenwich, agreed to sell her home, estimated to be worth $1.2 million, for $500,000, a month before she passed away.

The Attorney General's Office alleged that her neighbor, Mark Lovallo, had urged Johnson to sign off on the sales option while she was sick in the hospital. The deal also included her longtime accountant, David Alfano.

Blumenthal said that Johnson never intended to approve the deal, which would have significantly lowered the amount of money that would have been donated to eight of her favorite charities. Johnson's will divided nearly all of her $1.5 million estate to charities including the Greenwich Library and Perrot Memorial Library in Old Greenwich.

"I fought successfully to stop this suspect agreement denying hundreds of thousands of dollars to charities intended to benefit from the home's sale," said Blumenthal. "In charity law, the donor's wishes are paramount. This donor never wished to sell her home at a bargain-basement price, significantly slashing the proceeds to charities named in her will."

Blumenthal said the "suspect" agreement caught his attention because his office is in charge of enforcing charity laws and often reviews probate cases involving charitable donations.

"We were the only ones to challenge this agreement. It came to our attention through filings in the probate court," said Blumenthal.

If the sales agreement had gone through and Johnson's home was sold for $500,000, Blumenthal said the estate's total value would have been about $300,000 less.

"Ill and infirm, this woman supposedly signed papers while hospitalized and in the last month of her life, raising grave doubt the agreement reflected her true wishes," said Blumenthal.

Probate Judge Daniel Caruso voided the agreement earlier this month. The house will now be offered to Lovallo and Alfano for one month at the original fair market price at $1.2 million. Blumenthal said if they fail to act on the deal, the executor of the estate will put it on the market to be sold for at least $800,000 or more.

Johnson's estate also includes $700,000 in stocks and cash.

After expenses, all but $100,000 of the estate will be divided among eight charities including, Weimaraner Foundation, AKC Canine Health Foundation, Perrot Memorial Library, Greenwich Library, Cornell University Veterinarian School, University of Pennsylvania Veterinarian School, Tufts Veterinarian School and the Embroiders Guild.

Calls to Lovallo and Alfano Friday were not immediately returned.

See article here.

For information regarding estate planning look at our website here.

Attorney General Richard Blumenthal intervened after Mona Lee Johnson, of Greenwich, agreed to sell her home, estimated to be worth $1.2 million, for $500,000, a month before she passed away.

The Attorney General's Office alleged that her neighbor, Mark Lovallo, had urged Johnson to sign off on the sales option while she was sick in the hospital. The deal also included her longtime accountant, David Alfano.

Blumenthal said that Johnson never intended to approve the deal, which would have significantly lowered the amount of money that would have been donated to eight of her favorite charities. Johnson's will divided nearly all of her $1.5 million estate to charities including the Greenwich Library and Perrot Memorial Library in Old Greenwich.

"I fought successfully to stop this suspect agreement denying hundreds of thousands of dollars to charities intended to benefit from the home's sale," said Blumenthal. "In charity law, the donor's wishes are paramount. This donor never wished to sell her home at a bargain-basement price, significantly slashing the proceeds to charities named in her will."

Blumenthal said the "suspect" agreement caught his attention because his office is in charge of enforcing charity laws and often reviews probate cases involving charitable donations.

"We were the only ones to challenge this agreement. It came to our attention through filings in the probate court," said Blumenthal.

If the sales agreement had gone through and Johnson's home was sold for $500,000, Blumenthal said the estate's total value would have been about $300,000 less.

"Ill and infirm, this woman supposedly signed papers while hospitalized and in the last month of her life, raising grave doubt the agreement reflected her true wishes," said Blumenthal.

Probate Judge Daniel Caruso voided the agreement earlier this month. The house will now be offered to Lovallo and Alfano for one month at the original fair market price at $1.2 million. Blumenthal said if they fail to act on the deal, the executor of the estate will put it on the market to be sold for at least $800,000 or more.

Johnson's estate also includes $700,000 in stocks and cash.

After expenses, all but $100,000 of the estate will be divided among eight charities including, Weimaraner Foundation, AKC Canine Health Foundation, Perrot Memorial Library, Greenwich Library, Cornell University Veterinarian School, University of Pennsylvania Veterinarian School, Tufts Veterinarian School and the Embroiders Guild.

Calls to Lovallo and Alfano Friday were not immediately returned.

See article here.

For information regarding estate planning look at our website here.

Labels: Doc Prep

Estate Fraud,

Government,

Probate

Friday, July 17, 2009

You Can't Take It With You, But. . . .

You can't take it with you. But some executives have made sure they'll still get their pay even if they're dead.

Nabors Industries Ltd. will owe the estate of Eugene Isenberg, the 78-year-old chief executive of Nabors Industries Ltd at least $263.6 million if he died tomorrow. That's more than the first-quarter earnings at the Houston oil-service company.

The CEO of Shaw Group, whom the article didn’t mention by name, will rake in more than $17 million with his cold, dead hands in exchange for not competing with the company after he dies. Competing with a dead man?

Ceos, when they sign their hiring contracts, acquire fat severance packages, vested shares, a continuation of salaries, bonuses, and even “supercharged pensions”–after they die.

In many cases death benefits are for estate planning purposes a deferred compensation package often structured for tax reasons.

See the article referred to in this blog here.

See here for additional information regarding estate planning.

Nabors Industries Ltd. will owe the estate of Eugene Isenberg, the 78-year-old chief executive of Nabors Industries Ltd at least $263.6 million if he died tomorrow. That's more than the first-quarter earnings at the Houston oil-service company.

The CEO of Shaw Group, whom the article didn’t mention by name, will rake in more than $17 million with his cold, dead hands in exchange for not competing with the company after he dies. Competing with a dead man?

Ceos, when they sign their hiring contracts, acquire fat severance packages, vested shares, a continuation of salaries, bonuses, and even “supercharged pensions”–after they die.

In many cases death benefits are for estate planning purposes a deferred compensation package often structured for tax reasons.

See the article referred to in this blog here.

See here for additional information regarding estate planning.

Labels: Doc Prep

Estate Planning,

Estate Tax

Incomplete Pass--McNair and Estate Planning

Professional quarterback Steve Mcnair cheated on his wife and was killed by his girl friend. He had sons from prior liaisons with different women. He earned more than $75 million during his 13-year NFL career with the Titans and Ravens, and--you guessed it--he never completed any estate planning.

Professional quarterback Steve Mcnair cheated on his wife and was killed by his girl friend. He had sons from prior liaisons with different women. He earned more than $75 million during his 13-year NFL career with the Titans and Ravens, and--you guessed it--he never completed any estate planning.It appears that settling Steve McNair's affairs is going to be messy.

The Tennessean reports that the family of at least one of the two sons born before McNair's marriage will file a claim for a share of the slain quarterback's estate.

McNair didn't leave a will and his widow Mechelle has filed court papers saying she and sons Tyler, 11, and Trenton, 6, are the heirs. Mechelle's probate petition states that she cannot confirm whether two other boys are Mr. McNair's children.

One of those boys, McNair's oldest (alleged) son, Steven L. McNair Jr., is a senior and star wide receiver at Oak Grove High in Hattiesburg, Miss.

His second (alleged) son, Steven O'Brian Koran McNair, 15, lives in Mount Olive, Miss. The younger Steven's grandmother told the Tennessean that the boy received $500 a month for child support.

So many problems that could have been handled so easily with good estate planning.

Labels: Doc Prep

Estate Planning,

Inheritance Disputes,

Probate,

Trusts

Wednesday, July 15, 2009

Hobbit Heirs Getting Short End of the Stick?

Hobbit Heirs are asking for $220 Million in "Rings" earnings. The heirs say New Line used classic "Hollywood Accounting," which inflated expenses and excluded revenue from its accountings denying the family of any payments at all. Hollywood accounting has long been seen as attempt by movie studios to cheat authors out of royalty payments. The allegation is that the accounting formulas they use have been designed to ensure that it is mathematically impossible for any film to show a net profit.

Hobbit Heirs are asking for $220 Million in "Rings" earnings. The heirs say New Line used classic "Hollywood Accounting," which inflated expenses and excluded revenue from its accountings denying the family of any payments at all. Hollywood accounting has long been seen as attempt by movie studios to cheat authors out of royalty payments. The allegation is that the accounting formulas they use have been designed to ensure that it is mathematically impossible for any film to show a net profit.“Usually it’s not outright thievery by the studios, but death by contract,” Bloomberg quotes Pierce O'Donnel, the Los Angeles-based lawyer who represented the late columnist Art Buchwald in a successful case against Viacom Inc,s Paramount Pictures in 1988.

J.R.R. Tolkien sold movie rights to his “Lord of the Rings” novels 40 years ago for 7.5 percent of future receipts. Three films and $6 billion later, his heirs haven’t seen a dime from Time Warner Inc.

A jury will look at the accounting methods used by New Line Cinema, the Time Warner unit that made the movies, in October, where the lawsuit is set for trial in Los Angeles.

Studios' financial shenanigans were exposed in a lawsuit filed by writer Art Buchwald alleging that Paramount Pictures stole his script idea and turned it into the 1988 movie Coming to America starring Eddie Murphy. Buchwald won the lawsuit and was awarded damages, and then accepted a settlement from Paramount before any appeal took place.

The decision was important mainly for the court's determination in the penalty phase of the trial that Paramount used "unconscionable" means of determining how much to pay authors. Paramount claimed, and provided accounting evidence to support the claim, that despite the movie's US$350 million in revenues, it had earned no net profit, according to the definition of "net profit" in Buchwald's contract, and hence Buchwald was owed nothing.

Wikipedia states that "The court agreed with Buchwald's argument that this was "unconscionable", and therefore invalid. Fearing a loss if it appealed, and the subsequent implications of the unconscionability decision across all its other contracts, Paramount settled for undisclosed terms. The case was the subject of a 1992 book, Fatal Subtraction: The Inside Story of Buchwald v. Paramount by Pierce O'Donnell, the lawyer who represented Buchwald, and Los Angeles Times reporter Dennis McDougal"

Labels: Doc Prep

Estate Administration

Playmate's Fun Ends when Pre-nup Upheld by Utah Appellate Court

The Utah Court of Appeals has ruled that a former Playboy Playmate, Hope Marie Carlton, must pay for her multimillionaire ex-husband's legal fees, after the judges determined she is not entitled to share in his fortune, due to a prenuptial agreement.

The Utah Court of Appeals has ruled that a former Playboy Playmate, Hope Marie Carlton, must pay for her multimillionaire ex-husband's legal fees, after the judges determined she is not entitled to share in his fortune, due to a prenuptial agreement.When the couple married, Robert Keith Levin was a multimillionaire and Carlton a 25-year-old aspiring actress and former 1985 Playboy Playmate of the Month who earned about $40K a year.

The ruling states that Carlton is not entitled to co-ownership of a luxury resort or $1.5 million in profits from land development in San Juan County. Prior to their California marriage in 1991, Carlton and Levin entered into a prenuptial agreement that protected Levin's assets from being divided in the event of a divorce.

The ruling states that at the time of the marriage Carlton was a 25-year-old aspiring actress who had sporadic parts in movies and TV shows and was making as much as $44,000 in one year. Meanwhile Levin, who was 42 and semi-retired at the time of their marriage, was a multimillionaire.

After their marriage, the couple moved to Park City "where they lived a luxurious leisure lifestyle," according to the ruling. In 1994, the couple developed the Sorrel River Ranch Resort along the Colorado River just north of Moab.

After their marriage, the couple moved to Park City "where they lived a luxurious leisure lifestyle," according to the ruling. In 1994, the couple developed the Sorrel River Ranch Resort along the Colorado River just north of Moab.In addition to ruling against her, the Utah Court of Appeals also ordered Carlton to pay her ex-husband's legal fees of around $167,885. The ruling states the money owed will be deducted from her $15,000-a-month alimony at the rate of $2,500 a month until fully paid.

Story at the Deseret News

Labels: Doc Prep

Pre-nuptial agreements

She Gets to Keep It

Prenuptial agreements have not been recognized in English courts for more than 150 years - throughout the modern era in which divorce settlements have been a matter for civil law.

The refusal of the courts to recognize prenups has been based on the principle that couples have a duty to stay together and marriage is for life.

However, yesterday the Appeal Court declared the traditional thinking 'unrealistic' and out-of-date.

The Court established a change in the law. The judgment said that a large part of the Court's reasoning is that a person who is already divorced should have the chance to marry again, without jeopardizing his or her separate wealth and for the sake of children born of the first marriage.

The ruling recognizing the validity of the pre-nup agreement saves a German heiress named Katrin Radmacher from losing 5 million pounds to her ex-husband.

More at the Times Online

The refusal of the courts to recognize prenups has been based on the principle that couples have a duty to stay together and marriage is for life.

However, yesterday the Appeal Court declared the traditional thinking 'unrealistic' and out-of-date.

The Court established a change in the law. The judgment said that a large part of the Court's reasoning is that a person who is already divorced should have the chance to marry again, without jeopardizing his or her separate wealth and for the sake of children born of the first marriage.

The ruling recognizing the validity of the pre-nup agreement saves a German heiress named Katrin Radmacher from losing 5 million pounds to her ex-husband.

More at the Times Online

Labels: Doc Prep

Pre-nuptial agreements

Come Here Sweetie Little Hubby-Pig!

Nina Wang, a.k.a. Little Sweetie, is in the news again. The fight for her inheritance goes on. The fight is centered around the existence of two wills, one in 2002 which gives Wang's $4 billion dollar estate to a foundation linked to the family's privately-held company and one dated to 2006, which was drafted while Wang was suffering from cancer. This later will gives her estate to her feng shui master, Tony Chan, a married man 23 years younger than herself. Mr. Chan has been arguing his case based on claims he had a marital type relationship with Wang, even though he is married and has three children (one is named Wealthee Chan).

Nina Wang, a.k.a. Little Sweetie, is in the news again. The fight for her inheritance goes on. The fight is centered around the existence of two wills, one in 2002 which gives Wang's $4 billion dollar estate to a foundation linked to the family's privately-held company and one dated to 2006, which was drafted while Wang was suffering from cancer. This later will gives her estate to her feng shui master, Tony Chan, a married man 23 years younger than herself. Mr. Chan has been arguing his case based on claims he had a marital type relationship with Wang, even though he is married and has three children (one is named Wealthee Chan).Mr. Chan's case rests largely on his relationship with Mrs. Wang, reports the New York Times. He claims Wang had pet names for him and called him (translated from Cantonese) “Hubby,” “Hubbykins” and the rather unfortunate sounding “Hubby-pig.” This epic romance started out with a head rub that cost the wealthy land tycoon $6500.

Labels: Doc Prep

Inheritance Disputes,

Probate,

Wills

Tuesday, July 14, 2009

Estate Planning Purring Alert

Researchers in London have discovered that cats have what they call a "soliciting purr" to overpower their owners and get attention and food (and influence your will?). It's not regular purring; rather, it sort of incorporates a similar frequency to a human baby cry.

The team believes that cats have tapped into a human bias to respond to a sound they cannot ignore.

BBC

The team believes that cats have tapped into a human bias to respond to a sound they cannot ignore.

BBC

Labels: Doc Prep

Pet Trusts

Guaranteed Court Fight

Probate conflicts and issues involving blended families and second marriages are increasing. The issue is how to ensure that both the second spouse and the children from the first (or previous marriages) are taken care of. One of the problems is that if a spouse dies and leaves everything to the surviving spouse, the chance that the deceased spouse's children from prior marriages receiving an inheritance becomes pretty slim, even after the death of the second spouse.

Probate conflicts and issues involving blended families and second marriages are increasing. The issue is how to ensure that both the second spouse and the children from the first (or previous marriages) are taken care of. One of the problems is that if a spouse dies and leaves everything to the surviving spouse, the chance that the deceased spouse's children from prior marriages receiving an inheritance becomes pretty slim, even after the death of the second spouse.What often happens is that the children from the first family live to see the home they grew up in end up in the hands of the children of their step-parent. That can be a bitter pill to swallow.

The laws of the state will dictate what share your children are entitled to and they may end up in court disputing the value and nature of your property. It's expensive and it destroys relationship between step-parent and step-child and between siblings.

Estate issues involving step families can be complicated and emotional. Some of the disputes are intractable. Part of the problem is that there is often no pre-planning. If you are getting married and have children from a previous marriage, you are handing your children and new spouse a fistful of problems should they survive you.

See a lawyer to change your estate plan, or to create your first one before you get married.

Labels: Doc Prep

Estate Planning

I know, I'll Set up a Foundation to Benefit Myself!

U.S. Sen. Jim Bunning, R-Ky., pitched in the Major Leagues for 17 seasons, most notably with the Detroit Tigers and the Philadelphia Phillies. When he retired, he had the second-highest total of career strikeouts in Major League history; he is currently 17th.

U.S. Sen. Jim Bunning, R-Ky., pitched in the Major Leagues for 17 seasons, most notably with the Detroit Tigers and the Philadelphia Phillies. When he retired, he had the second-highest total of career strikeouts in Major League history; he is currently 17th. According to the Lexington Hearald-Leader at kentucky.com, he may have pitched himself one more strike out. Looks like Bunning set up a charitable foundation in 1996, the year he entered baseball's Hall of Fame. Every year since, he has been the fund's biggest recipient.

His non-profit collects money that Sen. Bunning gets by autographing baseballs. It has taken in half a million dollars.

Of that, the good senator and the foundation's sole employee, gets a salary of $180,000 in salary, working a laborious reported hour a week.

The foundation has actually given only a quarter of its income or $136,435, to churches and charitable groups around Northern Kentucky. The largest sums to local Catholic churches Bunning has attended.

Labels: Doc Prep

Foundations

Restricted Gifts Too Restrictive? Ask San Diego and then ask Detroit.

Joan Kroc, the widow of Ray, the founder of McDonald’s, left $1.8 billion to the Salvation Army in 2003. Kroc required the Salvation Army to build 30 community centers around the country.

Joan Kroc, the widow of Ray, the founder of McDonald’s, left $1.8 billion to the Salvation Army in 2003. Kroc required the Salvation Army to build 30 community centers around the country. The gift included an $30 million in construction costs and a $30 million endowment per center. From the beginning the Salvation Army questioned whether this was enough money to fund Kroc's ambition plan. It decided to ask each community to raise $21 million more as a condition to receiving a center. Only a third of raised only about a third of what it thinks is required.

Kroc's $1.5 billion-dollar dream was big and these were to be no ordinary community centers. San Diego's center was completed in 2002 at a cost of $87 million. It has three aquatic pools, an ice skating arena, skate park, and 600-seat theater.

Kroc's $1.5 billion-dollar dream was big and these were to be no ordinary community centers. San Diego's center was completed in 2002 at a cost of $87 million. It has three aquatic pools, an ice skating arena, skate park, and 600-seat theater. The Kroc center in Salem Oregon will open in September. It cost $40 million. It is a 92,000-sq.ft. facility that has two swimming pools - one deep enough to certify scuba divers, a rock climbing wall, computer labs, a gymnasium, a dance studio, commercial kitchen, and a 300-seat auditorium. Construction is underway for a $129.5 million project being built in Nicetown, Pennsylvania.

But the dream hasn't worked out in other areas. The financial climate since her death has changed considerably; only a few centers have been built. Two others are scheduled to open soon; at least two have been canceled. The endowment fund itself has lost 14% of its value and some of the intended communities have been unable to raise additional funds.

San Francisco Joan Kroc Center (left)

In addition to the financing problems, the plan has created divisions within the Salvation Army itself. There were fears that the organization might prove to be incapable of running such big operations and the centers were moving it away from its real mission "to preach the gospel of Jesus Christ and to meet human needs in His name without discrimination." To date that mission is carried out through youth camps, alcohol rehabilitation, elderly services, and Christmas charity services, to name a few.

Activists in Detroit are angry at the Army for scuttling their project. They claim the center is sorely needed and that the poor economy is more of an excuse. The real problems stem from bad fund-raising and a lack of interest from the Army itself.

Charitygovernance.com thinks the trouble is gifts that are too restrictive. Big donors should be more cautious when making gifts. Kroc was generous and well intentioned, but she had an agenda that she tried to impose on the Salvation Army.

It's one thing to direct your money to promote certain things and provide some guidance, but Kroc's bequest was to complex and detailed a program. She liked the Salvation Army enough to believe they would be good stewards, she should have trusted their judgment. "While we always acknowledge the right of donors to make the gifts, we also have always questioned whether such gifts are wise. Donors are lousy at predicting the future, as we have seen time and again."

Though she couldn't have predicted this economy and maybe overstepped on what the Salvation Army is comfortable with, a lot of good has been done so far. And it's not over yet.

Open:

San Diego, Omaha, Ashland, Oh, Atlanta, Couer D'Alene, Idaho.

In progress:

In progress:Grand Rapids, Memphis, Salem, Camden. Other sites are planned for Biloxi, Dayton,

Honolulu, Kerrville, TX Philadelphia, Quincy, IL, Augusta, GA, Boston, Charlotte, Chicago, Green Bay, Greenville, SC, Guayama, Puerto Rico, Long Beach, CA, Louisville, KY, Norfolk, VA, Phoenix, AZ, South Bend, IN, and Staten Island, NY.

Reader Update: Construction has now been started on the Kroc Centers in Biloxi, Mississippi and Kerrville, Texas.

Labels: Doc Prep

Charitable Giving

Monday, July 13, 2009

Things we always suspected

Wealthy women give away nearly twice as much as of their wealth as their male counterparts. WSJ's Wealth Report

Labels: Doc Prep

Charitable Giving

The entrepreneurial spirit meets easy rider

Motorcycles have been a part of A. Jay Howard’s life since he started riding at 16.

Motorcycles have been a part of A. Jay Howard’s life since he started riding at 16.Now, he has formed a business that will allow others who have lived with a love motorcycles to take their last journey under the power of a 2008 Harley-Davidson Road King Classic.

Coldwaterdailyreporter

Labels: Doc Prep

Funerals

Heir Hunters

Two half-sisters living 100 miles apart have discovered each other's existence - and their shares in a £23,000 fortune.

The story comes from the popular U.K. show "Heir Hunters."

The story is about the estate of 80-year-old bachelor from Yarmouth, England named Cyril Curtis. He appeared to have no relatives when he died last year. The story comes from the Great Yarmouth Mercury.

The probate research firm, Hoopers got into the picture and discovered two nieces. A brother of Curtis had married a woman and had his first daughter. The couple never divorced, but the brother went on to have a long-term relationship with another, during which he fathered another daughter. The two daughters never knew of the other's existence until the death of their uncle set of the investigation.

Here's a video clip from the third series of the popular program.

The story comes from the popular U.K. show "Heir Hunters."

The story is about the estate of 80-year-old bachelor from Yarmouth, England named Cyril Curtis. He appeared to have no relatives when he died last year. The story comes from the Great Yarmouth Mercury.

The probate research firm, Hoopers got into the picture and discovered two nieces. A brother of Curtis had married a woman and had his first daughter. The couple never divorced, but the brother went on to have a long-term relationship with another, during which he fathered another daughter. The two daughters never knew of the other's existence until the death of their uncle set of the investigation.

Here's a video clip from the third series of the popular program.

Labels: Doc Prep

Inheritance

Friday, July 10, 2009

It's Epidemic

Elder abuse is a growing threat in Salt Lake City. Two very recent cases of horrible abuse and neglect have given law enforcement officers pause to rethink how they respond. Too often it is seen as a family matter, especially financial abuse. It isn't it is a crime. A local KSL news report quotes the county sheriff saying that Salt Lake city used to get six elder abuse cases a year, now it's a twelve a month and it's a crime that's underreported.

Elder abuse is a growing threat in Salt Lake City. Two very recent cases of horrible abuse and neglect have given law enforcement officers pause to rethink how they respond. Too often it is seen as a family matter, especially financial abuse. It isn't it is a crime. A local KSL news report quotes the county sheriff saying that Salt Lake city used to get six elder abuse cases a year, now it's a twelve a month and it's a crime that's underreported.Law enforcement's Family Crimes Unit now holds monthly meetings to train more specifically for handling elder abuse.

Labels: Doc Prep

Elder Abuse

Somebody's gotta pay for this thing

Funding Health Care. Tax the rich, tax passive income, make big pharma pay, soda pop tax, make "non-profit" hospitals chip in more. These are the options currently on the table:

Funding Health Care. Tax the rich, tax passive income, make big pharma pay, soda pop tax, make "non-profit" hospitals chip in more. These are the options currently on the table: * Expanding the 1.45% Medicare payroll tax on earned income to "passive income," or unearned income, which could raise $100 billion;

* A 5% surtax on individuals who earn more than $500,000 and couples who earn more than $1 million;

* A tax on employer-sponsored health benefits at a level higher than previously considered, with one proposal to tax plans worth more than $20,300 for a family and $8,300 for an individual. The proposal could raise $240 billion. Another option would be to increase the cutoff to plans worth more than $25,000, which could raise $90 billion;

* Capping the tax break on itemized deductions at 28%, which could raise $168 billion, or a freeze on the top deduction rate at 35%, which could raise $90 billion;

* Issuing tax credit bonds to pay for the proposed Medicaid expansion, which could generate $75 billion in new revenue;

* Charging fees to pharmaceutical companies and insurers, which could generate up to $20 billion and $75 billion, respectively;

* Raising taxes on sugary drinks. A three-cent tax increase would generate $30 billion, while a 10-cent tax increase could result in $100 billion in new revenue (Budoff Brown/Rogers, Politico, 7/9); and

* Requiring that not-for-profit hospitals provide a minimum amount of charity care, which would both increase the amount of care provided that the federal government does not fund and force those hospitals not providing enough no-cost care out of tax-exempt status (Martinez, Wall Street Journal, 7/10);

Labels: Doc Prep

Government,

Taxes

Wednesday, July 8, 2009

Sounds Warm and Cozy

Hainsworth Coffins offers natural wool coffins and caskets.

"This is an innovative coffin and something completely new for the alternative coffin market, but the use of wool in burials is nothing new. The Burial in Wool Act of 1667 made it a legal requirement for the dead to be buried in woollen shrouds in an attempt to boost the struggling woollen industry of the time. With the current social eco agenda, rising concerns on the environmental impact of burials and this innovative product, the industry has come full circle.”

"This is an innovative coffin and something completely new for the alternative coffin market, but the use of wool in burials is nothing new. The Burial in Wool Act of 1667 made it a legal requirement for the dead to be buried in woollen shrouds in an attempt to boost the struggling woollen industry of the time. With the current social eco agenda, rising concerns on the environmental impact of burials and this innovative product, the industry has come full circle.”

H/T Boingboing.net

"This is an innovative coffin and something completely new for the alternative coffin market, but the use of wool in burials is nothing new. The Burial in Wool Act of 1667 made it a legal requirement for the dead to be buried in woollen shrouds in an attempt to boost the struggling woollen industry of the time. With the current social eco agenda, rising concerns on the environmental impact of burials and this innovative product, the industry has come full circle.”

"This is an innovative coffin and something completely new for the alternative coffin market, but the use of wool in burials is nothing new. The Burial in Wool Act of 1667 made it a legal requirement for the dead to be buried in woollen shrouds in an attempt to boost the struggling woollen industry of the time. With the current social eco agenda, rising concerns on the environmental impact of burials and this innovative product, the industry has come full circle.”H/T Boingboing.net

Labels: Doc Prep

Death-Dying-End of Life

Here's One You Don't See Every Day

COLUMBUS, Ohio -- As a thank you, a man has left $152,000 - half his estate - to the Ohio insurance company where he worked for 25 years.

In his will, Jack Boyle said the bequest to Columbus-based State Auto Insurance Cos. was in gratitude for his livelihood and his good pension in retirement.

Boyle was a claims representative in Cleveland from 1953 until he retired to Boca Raton, Fla., in 1978. He was 91 when he died in Florida last year.

In his will, Jack Boyle said the bequest to Columbus-based State Auto Insurance Cos. was in gratitude for his livelihood and his good pension in retirement.

Boyle was a claims representative in Cleveland from 1953 until he retired to Boca Raton, Fla., in 1978. He was 91 when he died in Florida last year.

Labels: Doc Prep

Inheritance

Defending the Homeland

Just like in the children's book "The Little House," by Virginia Lee Burton, the city imposes itself on the little house. But this little house wouldn't go.

Just like in the children's book "The Little House," by Virginia Lee Burton, the city imposes itself on the little house. But this little house wouldn't go.In place of the working class Scandinavian families and cottages, the Ballard neighborhood in Seattle became home to industrial buildings, chemical plants, abandoned lots, and garbage left everywhere. Edith Macefield's house was the last one standing on her block. Government assessors put the value of the house and land as less than $110,000.

In recent years gentrification saw the neighborhood fortunes change once again. Developers rushed in but Edith Macefield refused to sell her 108-year old little cottage. She refused developer offers of nearly $1 million. She's been there for over fifty years; she wanted to stay. And that was that. Soon her little house was surrounded by a five story health club and a Trader Joe's.